Simplify Data Access

Aggregating data from various sources ensures that wealth managers have easy access to comprehensive information without needing to navigate multiple platforms.

Enhance Decision-Making

By providing a holistic view of market trends and insights, data aggregation supports financial advisors to make more informed and strategic decision for their clients.

Improve Client Engagement

Understanding client behavior through aggregated data allows for the creation of personalized experiences, enhancing client satisfaction and engagement.

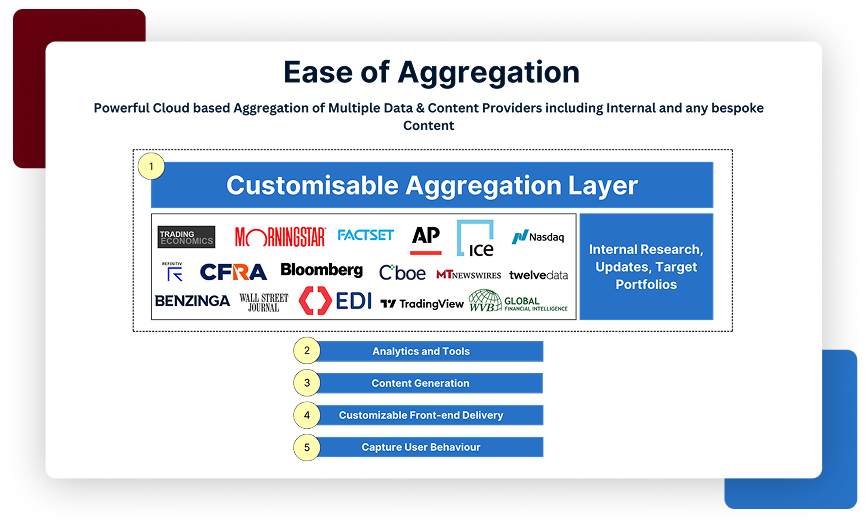

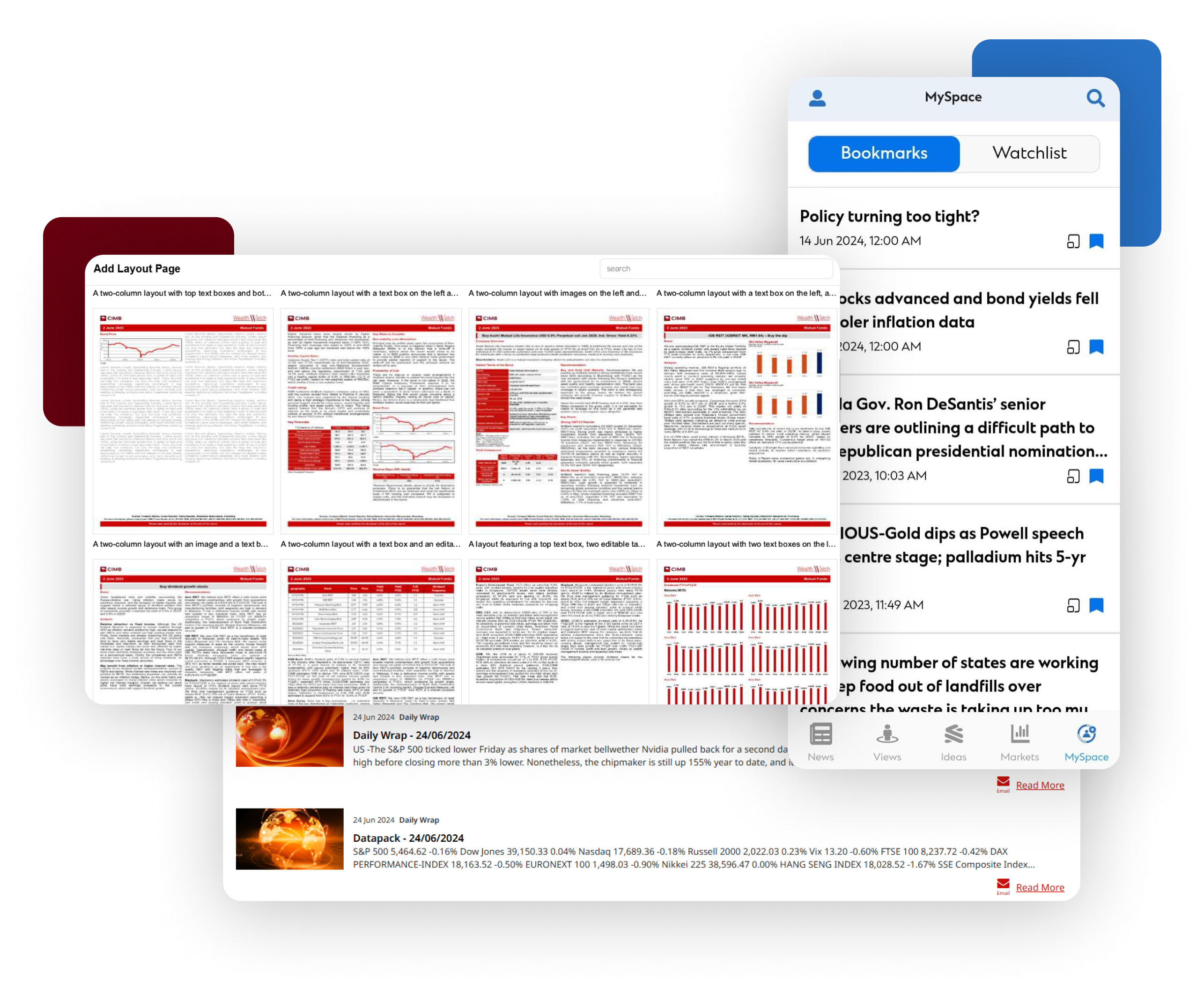

Customizable Data Aggregation Services

Our platform’s flexible aggregation layer works by seamlessly integrating data from both internal research teams and external content providers. This system can be customized to include bespoke content, adapting to your unique requirements and enhancing your research capabilities. It consolidates diverse data sources into a unified format, making it easier to access and analyze.

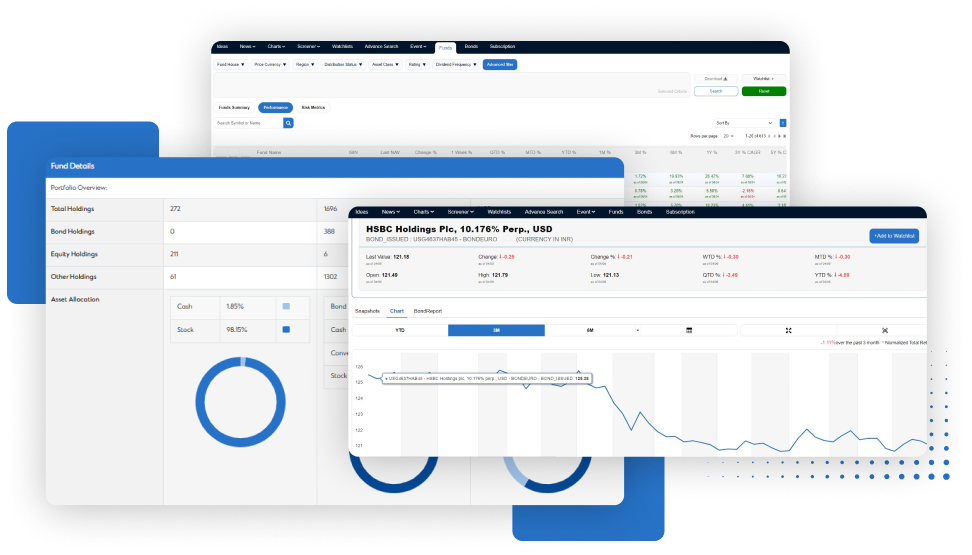

Comprehensive Market Data Aggregation and Insights

By aggregating data from premium market data sources, news providers, and analytical tools, our platform offers timely and relevant market information. This data helps you stay ahead of market trends, driving strategic decision-making and optimizing your investment strategies.

- Over 1 million articles from Refinitiv, Newswires, and more

- Daily updates on equities, bonds, and FX

- Data points across Equities, Mutual Funds, and Bonds data from trusted sources like Morningstar, End-of-Day and stay up-to-date with the latest market trends

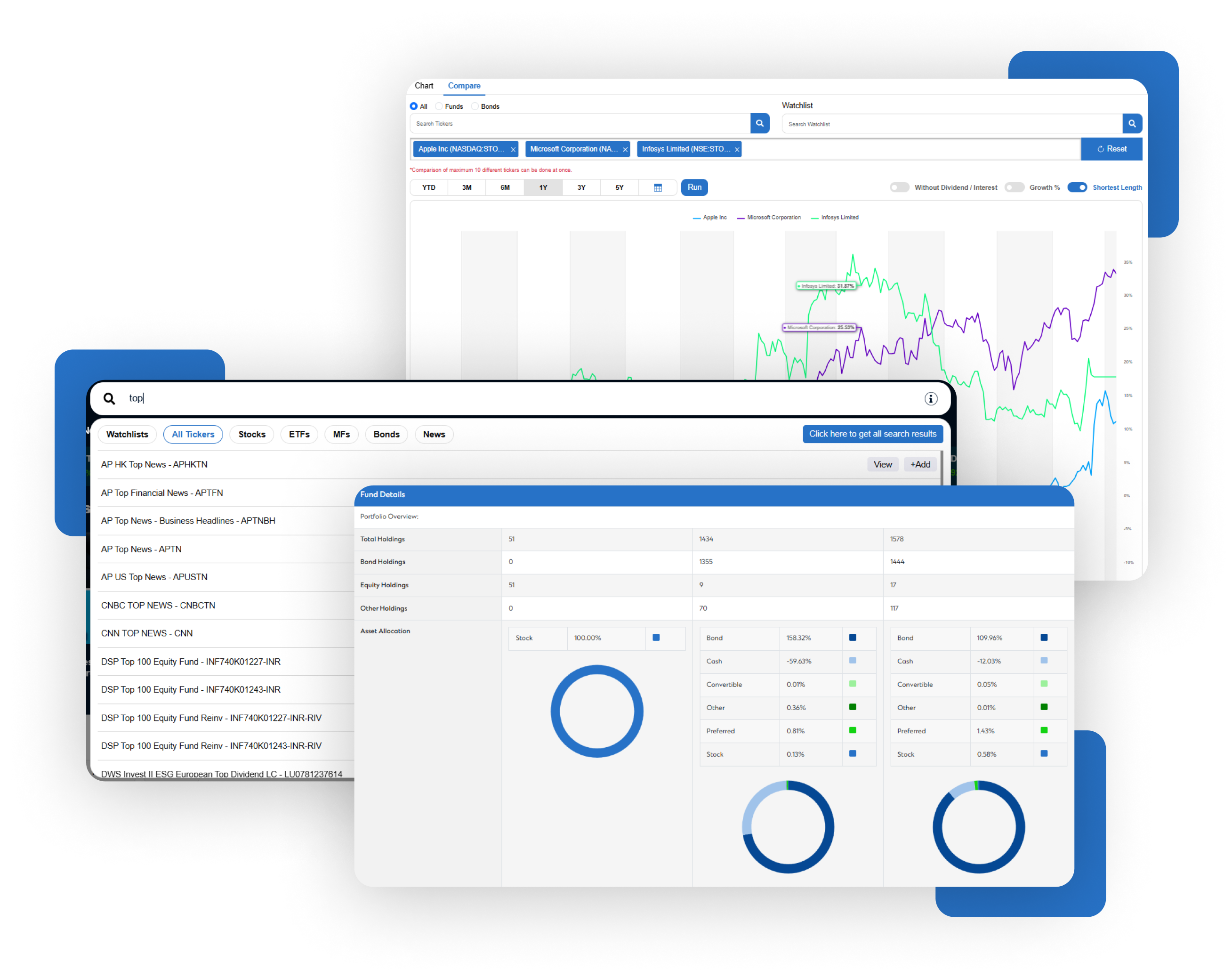

Advanced Tools and Alerts

Our suite of advanced tools leverages aggregated data to provide functionalities such as screener, compare, intelligent search, and watchlist-based alerts. These tools enable effective monitoring and analysis of market movements, ensuring you capture every critical market signal. The data aggregation process ensures that all relevant data points are considered in these analyses.

User Behavior Analytics

Understand your clients better by capturing every click and interaction. This aggregated data provides detailed analytics on user behavior, allowing you to tailor your services to meet specific client needs and preferences.

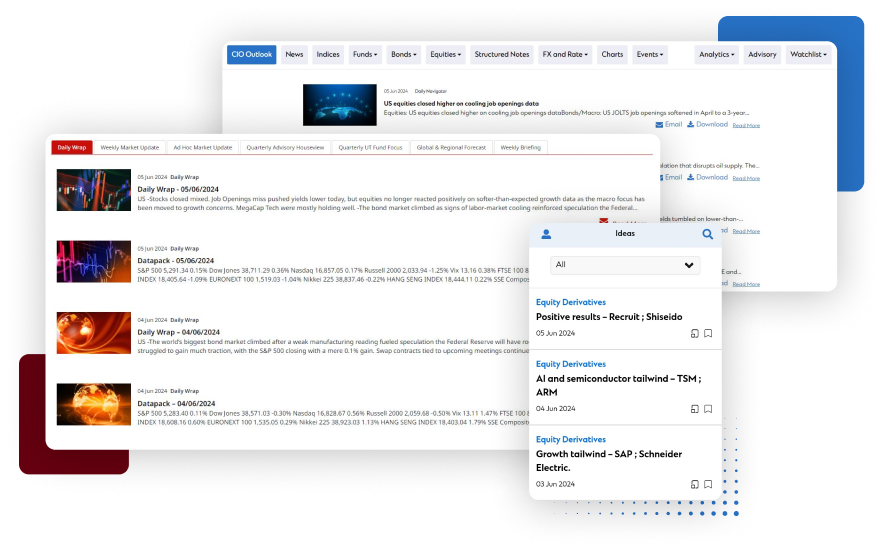

Personalized Content Generation

Regular broadcasts of personalized content ensure you are always equipped with actionable insights. These personalized insights prompt inbound client calls, fostering deeper engagement and enhancing client satisfaction.

Seamless and Efficiency Integration

Our data aggregation platform sits outside the bank’s core technology infrastructure, making the implementation process swift and straightforward. This design not only ensures rapid deployment but also minimizes disruptions to your existing operations.

By leveraging our state-of-the-art data aggregation capabilities, you can transform how you engage with your clients, manage risks, and execute trades.

Want to learn more about Agrud?

We are helping our clients save approximately 25% in wealth management costs and boost relationship manager productivity by 50%.

Make an Enquiry