Comprehensive Insights

By integrating raw, derived, and event-based data, our platform provides a holistic view of the market, enhancing your analytical capabilities.

Customization

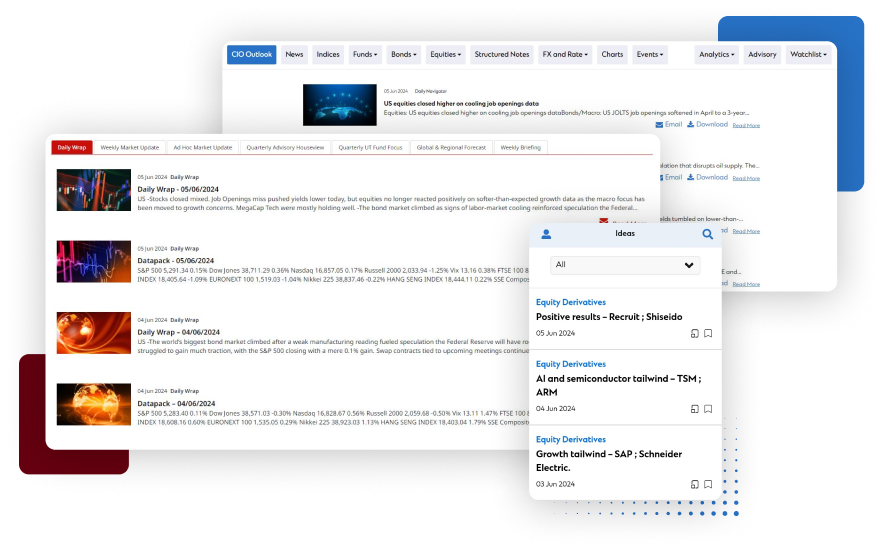

The platform allows for customizable content creation, tailoring insights to your specific needs and preferences.

Relevance

NLP-generated keywords ensure that the content is always relevant to current market conditions and specific tickers.

NLP-Generated Keywords Mapped to Tickers

Our platform uses natural language processing to generate keywords from news content, which are then mapped to relevant tickers. This ensures that the generated content is highly relevant to specific securities and market movements.

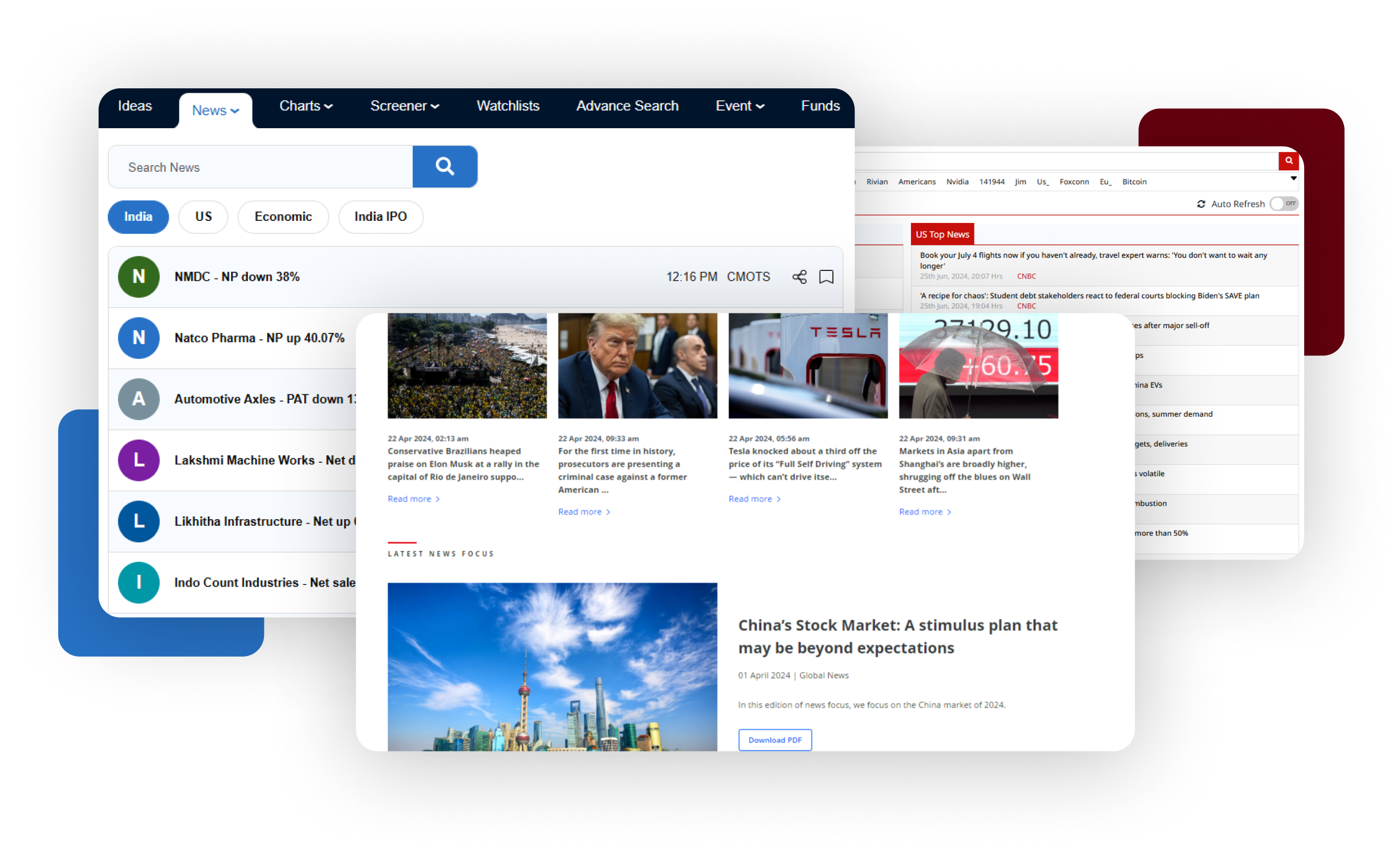

Comprehensive News Coverage

We process over one million global news content daily from sources such as Web Refinitiv Newswires, MT News, and AP News. This extensive coverage ensures that you are always updated with the latest market developments.

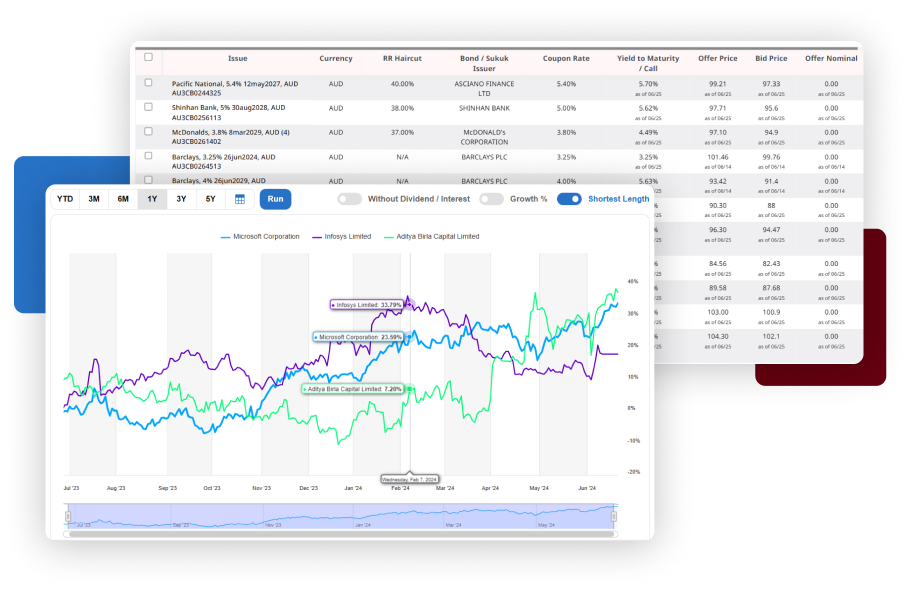

Price Analytics

Our platform delivers daily data on 50,000 tickers, encompassing equities, mutual funds, bonds, and foreign exchange. This data is sourced from Morningstar and other end-of-day data providers, ensuring a comprehensive view of market performance. Utilizing our in-house analytics, we transform this data into comprehensive, easy-to-understand interfaces and tools, empowering users with clear and actionable insights.

Fundamental Analytics

We offer detailed fundamental analytics, including balance sheet analysis, profit and loss statements, cash flows, estimates, and fund holdings. This data is essential for in-depth financial analysis and decision-making. We then transform this information into customizable tools and graphical representations, making it easier for users to analyze and interpret the data effectively.

Event-Based Data

Our platform tracks actual versus expected analytics for key events such as earnings releases, dividends, Federal Reserve meetings, and economic releases. This data helps you stay ahead of market impact and trends, providing invaluable insights for our users. By leveraging this detailed information, you can make informed decisions and stay ahead of the competition in the dynamic financial landscape.

Human-Moderated GenAI Content

While our GenAI technology generates content, we also incorporate human moderation to ensure accuracy and context. This hybrid approach combines the efficiency of AI with the overlay of human expertise.

Want to learn more about Agrud?

We are helping our clients save approximately 25% in wealth management costs and boost relationship manager productivity by 50%.

Make an Enquiry