ClientApp: Solving the Poor Digital Engagement in Retail Wealth with Our Wealth Management Tool

ClientApp by Agrud Technologies is not just a platform; it’s a partnership in enhancing client engagement and optimizing financial outcomes. Leveraging extensive user behavior data, ClientApp offers a comprehensive suite of features including Market Data, Personalized Ideas, and Premium Content. Its robust features and real-time capabilities make it an indispensable tool for wealth managers aiming to excel in today’s dynamic financial landscape. ClientApp caters to each client’s specific needs and financial objectives.

The Only Solution to Enhance Personalization for Wealth

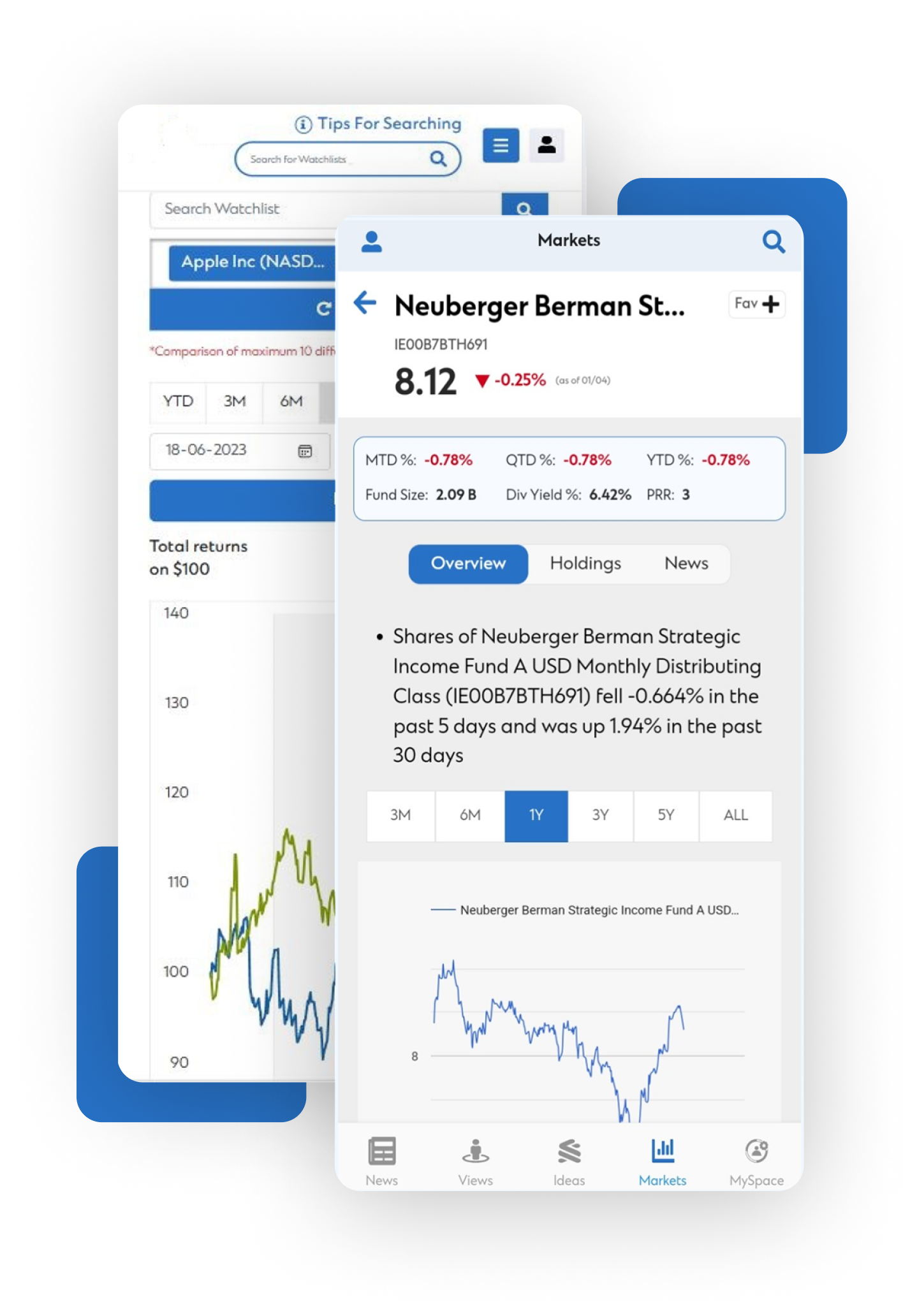

All Assets in One Glance

Explore the power of an advanced search engine to explore a vast array of financial data, from market trends to individual securities, with unparalleled ease and precision.

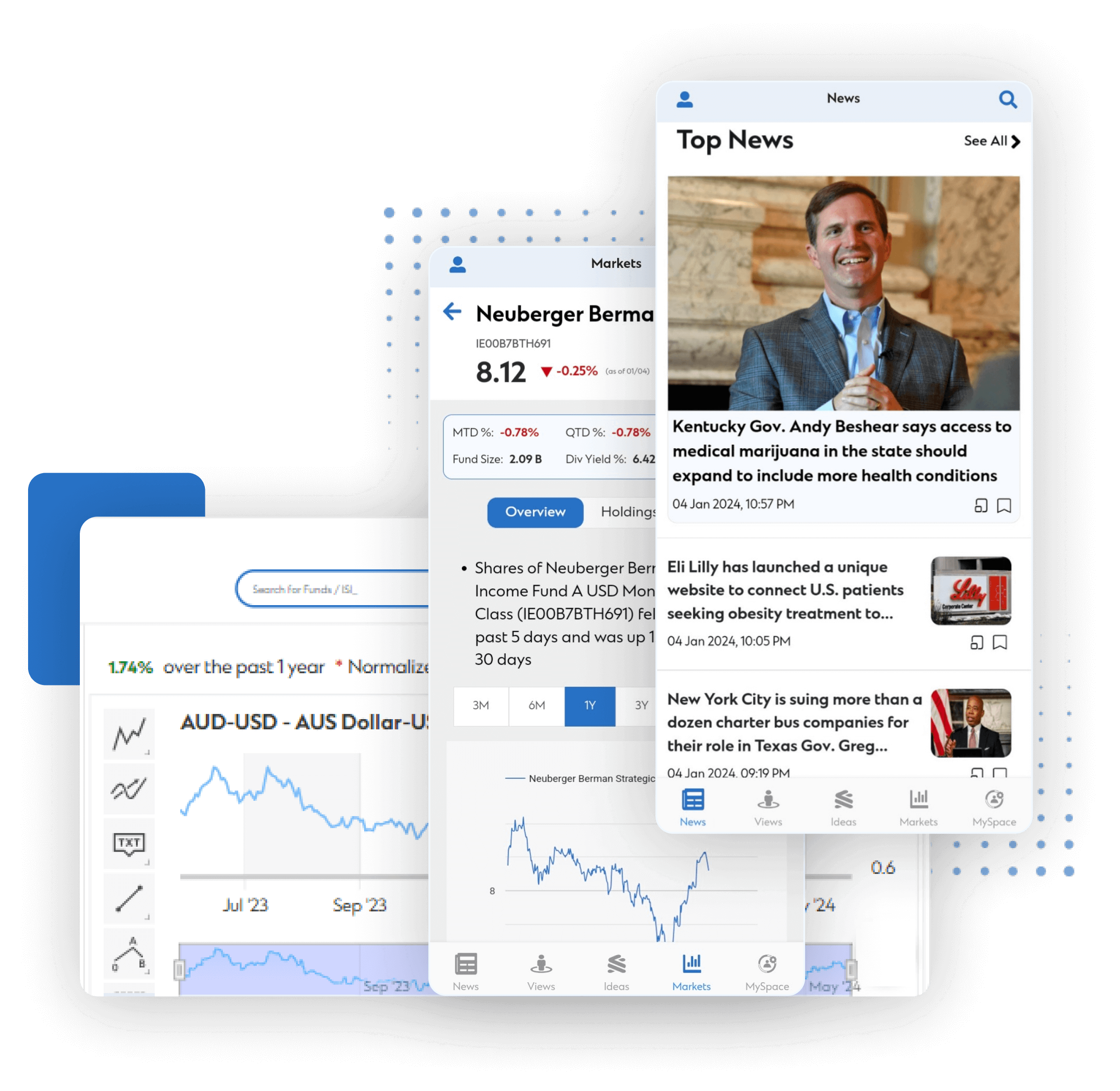

News You Need in One Place

Keep your finger on the pulse of the market with trending and high-quality regional and international news supported by relevant images, ensuring you're always informed about critical financial developments.

Customized User Experience

Tailor the application to your specific needs with personalized watchlists, alerts, and a rich repository of in-house content, including reports, podcasts, and videos.

ClientEngage with a “always on” - HOOK for Engagement and Sits Outside the Bank Network

ClientApp integrates seamlessly with your existing systems through a fully customizable B2B2C platform. It operates outside traditional banking networks but remains connected through APIs, ensuring data security and real-time responsiveness. The “Always On” feature of ClientApp keeps you a step ahead, engaging clients with personalized data insights and actionable calls to action, transforming passive interactions into active opportunities.

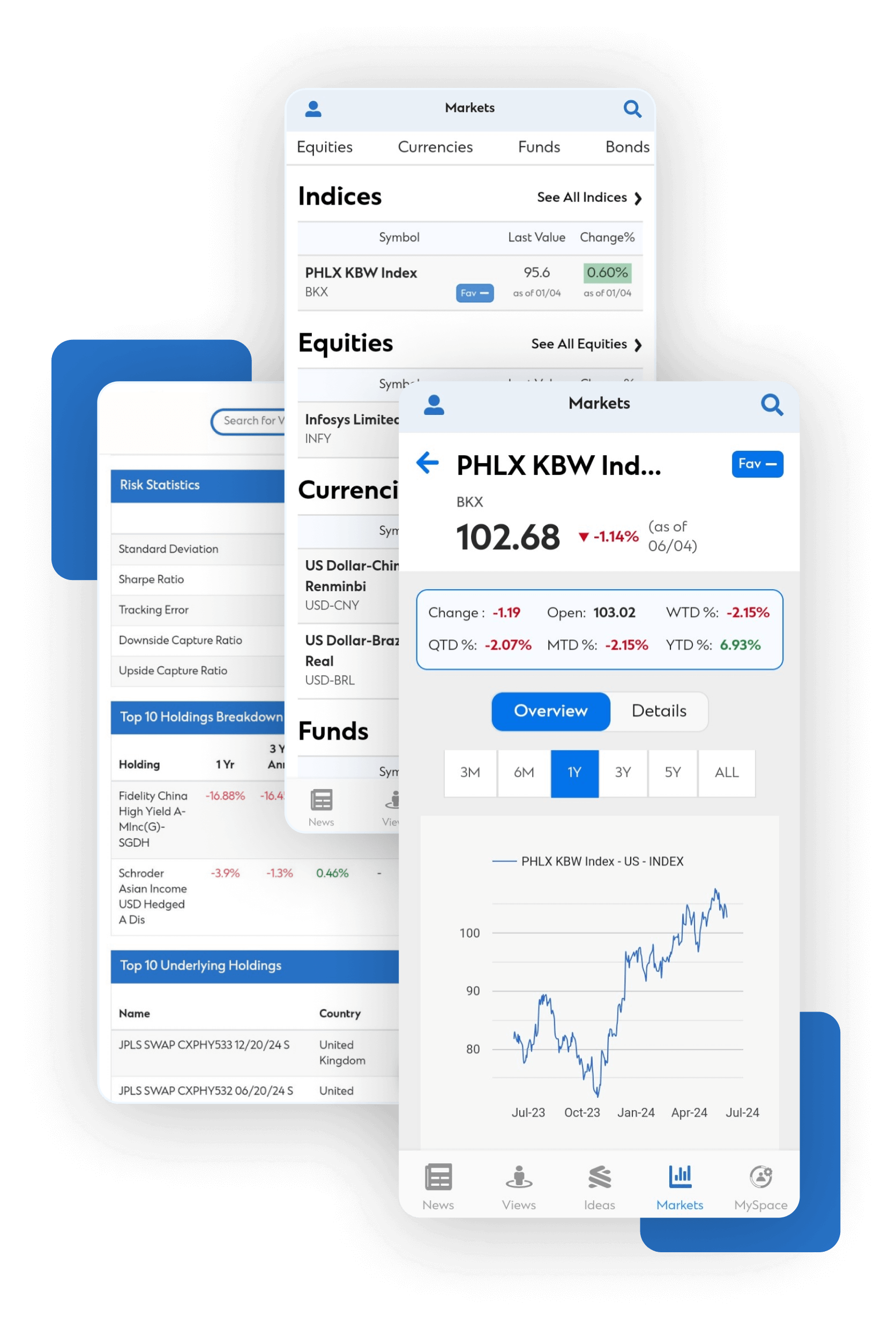

Dynamic Market Insights and Client’s Internal Content

Stay ahead of the market curve with market data across equities, funds, bonds, commodities, and currencies. Key metrics, trading statistics & detailed descriptions to help you make informed wealth decisions Read/Download reports, watch videos, and listen to podcasts all on one platform.

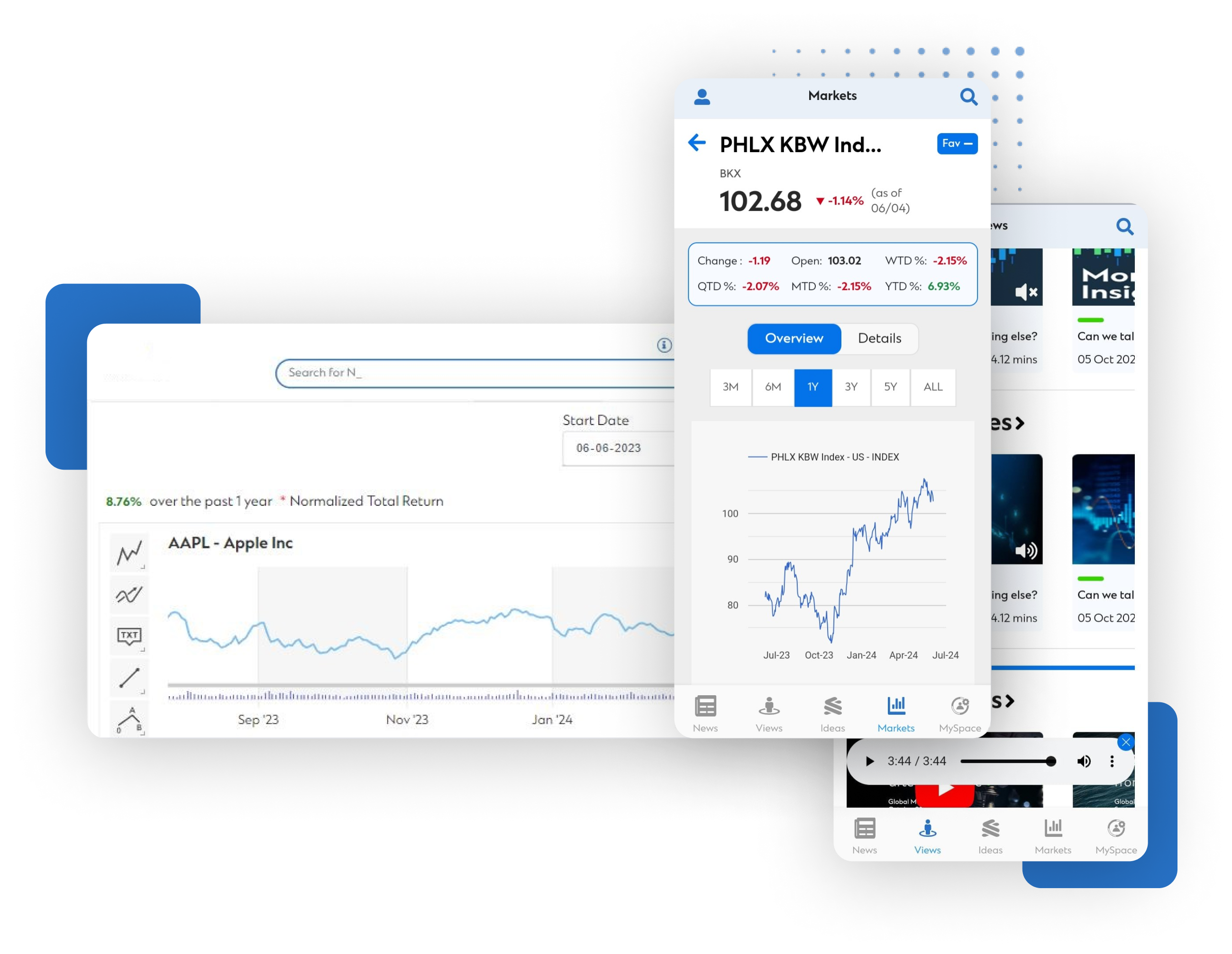

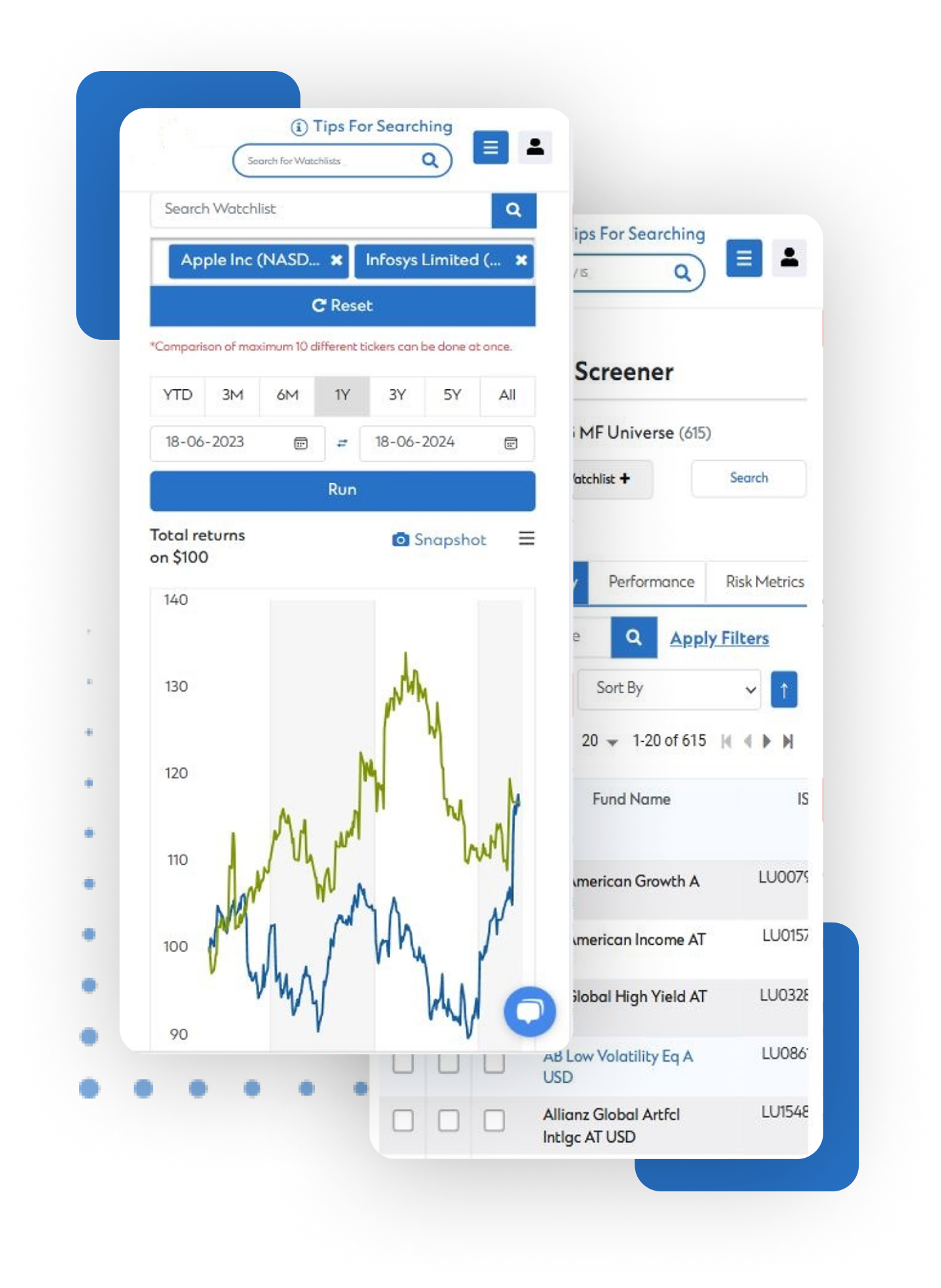

Advanced Tools for Detailed Financial Analysis

- Interactive Comparison Tools: Compare different Securities and track their performance with user-friendly visual representations and detailed metrics.

- Versatile Charting Tools: Gain intricate insights with advanced charting functionalities, allowing for a thorough analysis of market trends and asset performance.

- Effective Screener Tool: Select criteria and get the best securities as per your investment strategy with the functionality to choose asset allocation.

- Tailored Alerts: Get Curated Alerts based on your preferences or followed watchlists.

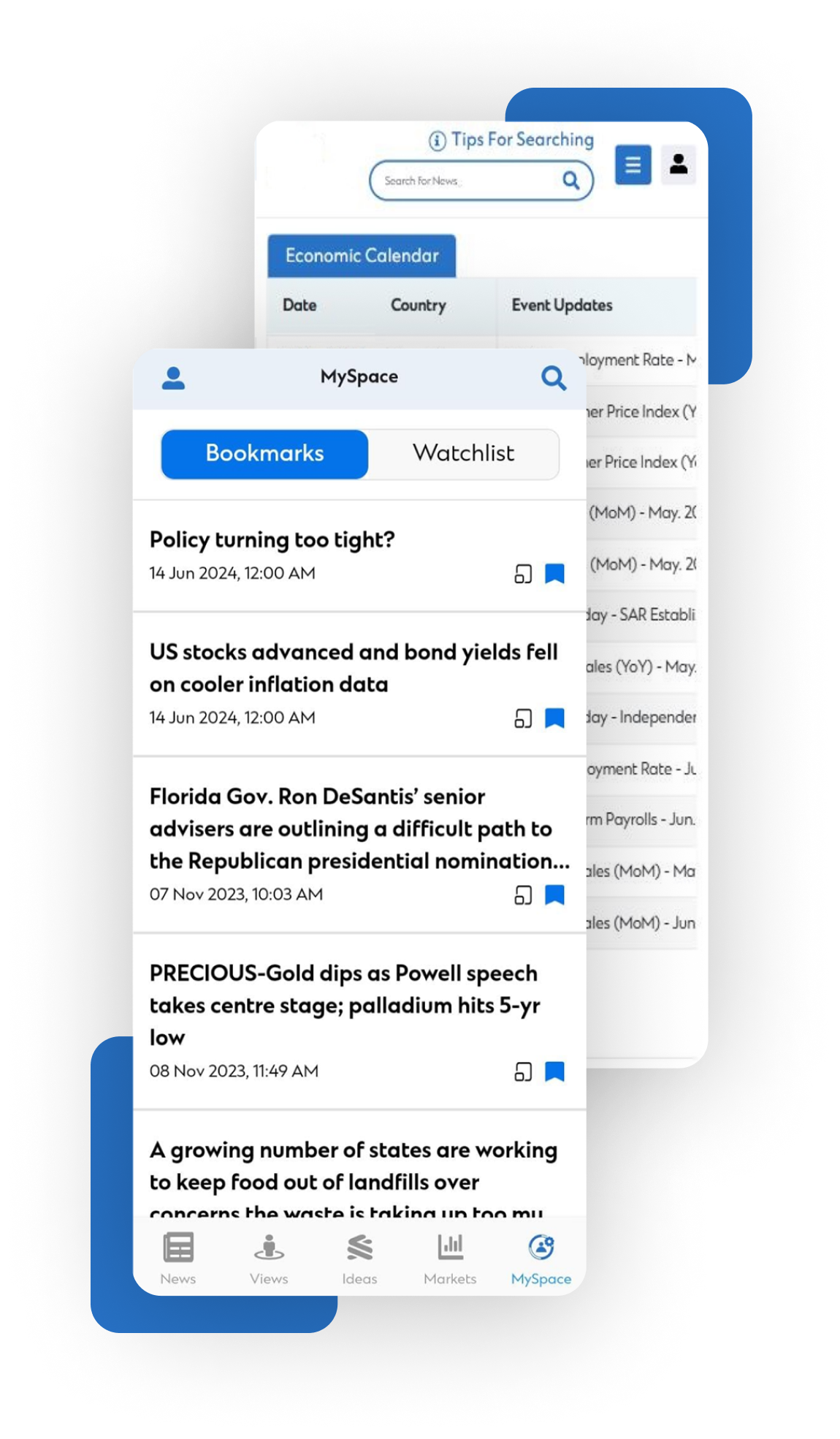

Personalized Customer Experience with MySpace and Economic Calendar

Customize each client’s experience with MySpace, where personal preferences and essential information converge to create a uniquely personal interface. Stay proactive with a dynamic economic calendar that keeps your clients informed of key market events and potential impacts on their investments.

A Robust Framework for Risk Management

ClientApp enhances your existing risk management processes by incorporating bank-specific risk profiles and client data into its personalization engine. This integration allows for proactive management of client portfolios, aligning with their risk appetite and investment goals.